The Goods and Services Tax (GST) is a prominent shift in how indirect taxes operate across different nations. The GST number is a major asset for businesses and their adherence to tax regulations. This article aims to explore the existence of GST numbers, including their function,makeup and importance within the business realm.

GST has redefined indirect taxation in numerous countries. Above all, the GST number is vital for ensuring the following of rules and regulations related to paying taxes. The following write up will look deep into the nature of GST numbers, their purpose, structure,, and significance in the field of business in a detailed manner.

What is GST?

GST, or Goods and Services Tax, is a tax added to the value of most goods and services sold for use within a country. It covers a wide range of items and services that aim to prevent the buildup of taxes at different stages of sales or production. The idea of GST was took place in France during the 1950s and has been taken up by many countries, each with its own way of implementing it.

Understanding GST Numbers

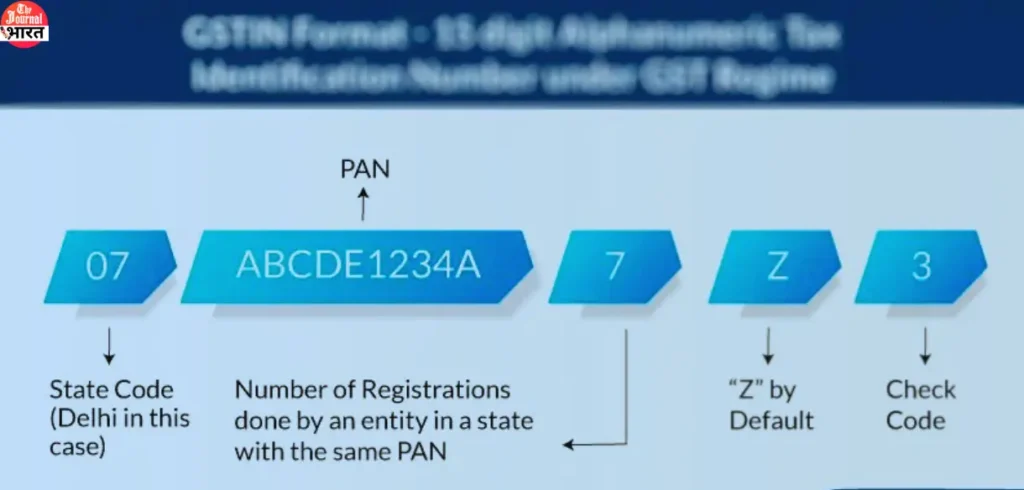

GST numbers, also known as GSTIN (GST Identification Number), are unique to each registered taxpayer in countries that use this system, like India. A typical GSTIN is a 15-character alphanumeric code, where the first two digits represent the state code, the next ten characters are the PAN or TAN of the taxpayer, the thirteenth digit represents the entity number of the same PAN holder in a state, the fourteenth character is ‘Z’ by default, and the last digit is a check code.

Here are 30 sample of GST numbers:

| Sr. No. | State | GST Provisional Certificate No. | PAN | TAN |

|---|---|---|---|---|

| 1 | Maharashtra | 27AABCC8274C1Z5 | AABCC8274C | MUMC12345C |

| 2 | Delhi | 07AABCC8274C1Z6 | AABCC8274C | DELC12345C |

| 3 | Karnataka | 29AABCC8274C1Z7 | AABCC8274C | BLRC12345C |

| 4 | Tamil Nadu | 33AABCC8274C1Z8 | AABCC8274C | CHEC12345C |

| 5 | Gujarat | 24AABCC8274C1Z9 | AABCC8274C | AHMC12345C |

| 6 | West Bengal | 19AABCC8274C1Z0 | AABCC8274C | CALC12345C |

| 7 | Rajasthan | 08AABCC8274C1Z1 | AABCC8274C | JAIC12345C |

| 8 | Uttar Pradesh | 09AABCC8274C1Z2 | AABCC8274C | LKOC12345C |

| 9 | Kerala | 32AABCC8274C1Z3 | AABCC8274C | KOCC12345C |

| 10 | Punjab | 03AABCC8274C1Z4 | AABCC8274C | CHDC12345C |

| 11 | Andhra Pradesh | 28AABCC8274C2Z0 | AABCC8274C | HYDC12345C |

| 12 | Telangana | 36AABCC8274C2Z1 | AABCC8274C | HYDC12346C |

| 13 | Odisha | 21AABCC8274C2Z2 | AABCC8274C | BHUC12345C |

| 14 | Bihar | 10AABCC8274C2Z3 | AABCC8274C | PATC12345C |

| 15 | Jharkhand | 20AABCC8274C2Z4 | AABCC8274C | RANC12345C |

| 16 | Chhattisgarh | 22AABCC8274C2Z5 | AABCC8274C | RPRC12345C |

| 17 | Haryana | 06AABCC8274C2Z6 | AABCC8274C | HRMC12345C |

| 18 | Himachal Pradesh | 02AABCC8274C2Z7 | AABCC8274C | SHMC12345C |

| 19 | Jammu & Kashmir | 01AABCC8274C2Z8 | AABCC8274C | SRNC12345C |

| 20 | Uttarakhand | 05AABCC8274C2Z9 | AABCC8274C | DEDC12345C |

| 21 | Assam | 18AABCC8274C3Z0 | AABCC8274C | GHYC12345C |

| 22 | Meghalaya | 17AABCC8274C3Z1 | AABCC8274C | SHLC12345C |

| 23 | Tripura | 16AABCC8274C3Z2 | AABCC8274C | AGTC12345C |

| 24 | Manipur | 14AABCC8274C3Z3 | AABCC8274C | IMPC12345C |

| 25 | Nagaland | 13AABCC8274C3Z4 | AABCC8274C | KOHC12345C |

| 26 | Arunachal Pradesh | 12AABCC8274C3Z5 | AABCC8274C | ITNC12345C |

| 27 | Sikkim | 11AABCC8274C3Z6 | AABCC8274C | GANG12345C |

| 28 | Mizoram | 15AABCC8274C3Z7 | AABCC8274C | AIZC12345C |

| 29 | Goa | 30AABCC8274C3Z8 | AABCC8274C | PANC12345C |

| 30 | Andaman and Nicobar Islands | 35AABCC8274C3Z9 | AABCC8274C | PORT12345C |

Registration for GST

Businesses that reach a specific turnover threshold must register for GST. While the registration process is simple, it demands careful attention to documentation and meeting eligibility criteria.

It is essential to understand the structure of this number is for businesses to ensure adherence and accurate invoicing.Lets lead you through a step-by-step guide to acquire a GST number.

Uses of GST Numbers

The GST number isn’t only a rule to follow; it’s crucial in many business dealings, including claiming tax credits and invoicing. It’s also necessary for filing GST returns and undergoing audits.

GST and Small Businesses

It’s crucial for small businesses to adhere to GST regulations. Let’s explore how GST affects small businesses and offer advice for easy adherence:

Inter-State vs Intra-State GST

Depending on whether a transaction occurs between states or within a state, different GST rules come into use. Let’s examine these differences and their impact on the use of GST numbers.

Filing GST returns is a regular process that businesses need to undertake. Let’s discuss the different types of GST returns and their role in this process.

- Non- adherence to GST regulations can result in various penalties.

- When comparing GST in your country to similar taxes in other nations, we’ll examine GST numbers in the realm of international trade and their counterparts on a global scale.

- The involvement of technology in overseeing GST adherence has been increasing. We’ll examine current trends and potential future advancements in this area.

Conclusion

Understanding GST numbers is more than simply meeting regulatory standards; it’s a crucial aspect of modern business operations. This guide strives to offer a clear knowledge of GST numbers, their structure, and their significance.

FAQ

Q. What is a GST number used for?

A. A GST number is used for tax identification, filing GST returns, claiming input tax credits, and ensuring compliance in business transactions.

Q. How do I find my GST number?

A. You can find your GST number on your GST registration certificate, on invoices received from your GST-registered suppliers, or by checking online through the GST portal or government tax websites.

Q. Can small businesses benefit from GST?

A. Yes, small businesses can benefit from GST by simplifying tax regulation adherence, enhancing their competitive position in the market, accessing input tax credits, and

Q. What happens if I don’t comply with GST regulations?

A. Non-compliance with GST regulations can lead to penalties, fines, and legal actions, including the cancellation of the GST registration.

Q. Are GST numbers used in international trade?

A. GST numbers are primarily used for domestic transactions. In international trade, other forms of tax identification like Import Export Code (IEC) are more commonly used. However, GST numbers are important for export and import businesses within the GST framework.