Why SEBI-Registered Telegram Channels Are Crucial for Safe and Informed Investing

These channels are managed by individuals or firms officially registered with the Securities and Exchange Board of India (SEBI), ensuring legal authority to provide investment advice. Their content is regulated, transparent, and accountable—making them a safer choice than unregistered groups or “influencer” channels that operate in opaque “education only” grey areas.

Top SEBI‑Registered Channels

According to the JournalBharat curated list and corroborated by other expert roundups, these SEBI-registered channels are often recommended:

1. Stock Gainers

- Led by SEBI‑registered analyst Kapil Verna.

- Offers intraday, swing, and BTST calls with clear entry-exit levels, stop-loss, and target prices.

- Recognized for teaching alongside tip delivery, ideal for beginners.

2. SharesNservices.com

- Boasts over 25 years of research experience.

- Free recommendation channel, with optional premium training courses.

- Covers equity, intraday, and positional advice.

3. Equity99

- Known for a 90% self-reported accuracy rate.

- Combines short- and long-term stock ideas, mutual fund recommendations, and fundamental analysis.

4. Eqwires Research Analyst

- Focused on high-frequency intraday tips for equities, Nifty and BankNifty futures.

- Offers performance-tracking, detailed packages, and webinars.

5. VG Stock Research

- Specializes in Nifty and BankNifty calls.

Provides free tips with no-fluff market commentary.

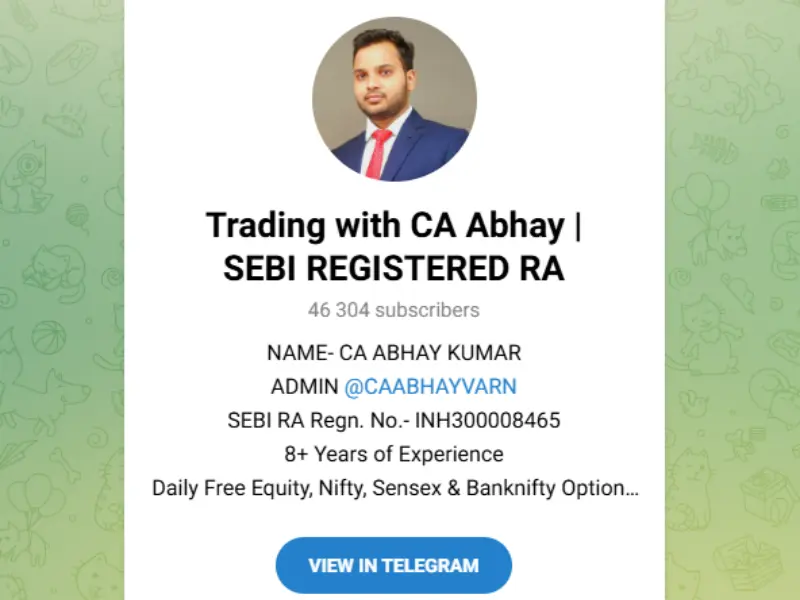

6. Trading with CA Abhay

- CA Abhay is a SEBI-certified research analyst.

- Shares equity, options, BankNifty calls with chart-based rationale, and also provides educational breakdowns.

7. A1 FREE Intraday Tips

- Offers intraday, BankNifty, F&O, BTST level calls with about 75% claimed accuracy.

- Completely free and daily push notifications.

📝 Additional Trusted Channels from Broader Sources

Other credible aggregators (StockDigest, LearnSharks, Finosauras, etc.) list these top SEBI‑registered channels frequently cited by expert reviewers.

- StockPro Online (StockPro Official) – Dr. Seema Jain leads this high‑accuracy, well‑structured channel offering both free/paid trades and educational programs.

- Harsh Bhagat – Known for disciplined intraday, swing, and options calls, mostly around Nifty and BankNifty.

- Usha’s Analysis – Daily intraday tips with risk control mechanisms, clear trade logic, and learning support.

- Minish Patel (3MP® Safe Calls) – Massively scaled channel with rapid trades; both free and premium calls.

- Index Trading with CA Nitin Murarka – Focused on futures/options and useful for structured positional strategies.

- Everyday Profits, Rupee Gainers, Hold with Priyank, DEEPAK WADHWA, Way2Laabh, Booming Bulls Academy, Nifty 50 & Stocks, and Equity99 (again listed) — all SEBI‑registered, covering a mix of intraday, swing, equity and options.

📊 Comparison Table: Key SEBI‑Registered Channels

| Channel | Subscribers | Focus Areas | Free/Paid | Notable Features |

|---|---|---|---|---|

| Stock Gainers | ~130 k | Intraday, Swing, BTST | Free+Premium | Clear charts, high accuracy, SEBI-regulated |

| StockPro Online (Dr. Jain) | ~286 k | Equity, Ronnie-positional trades | Free+Premium | Educational modules, high accuracy |

| Usha’s Analysis | ~195 k | BankNifty, Intraday | Free+Paid | Risk management, structured calls |

| Equity99 | ~127 k | Long-term & Short-term equity | Free | Fundamental + technical analysis |

| Eqwires Research Analyst | ~11 k | Intraday F&O | Free+Paid | F&O strategies, webinars |

| VG Stock Research | ~1–2 k | Nifty/BankNifty scalps | Free | Niche focus, minimal noise |

| Trading with CA Abhay | ~51 k | F&O, Chart analysis | Free | CA-credential backed tips |

| A1 FREE Intraday Tips | ~9 k | Intraday, BTST, F&O | Free | Daily free calls, accessible design |

| Minish Patel (3MP® Safe Calls) | ~1.1M | Mixed (incl. intraday/options) | Both | High volume calls, experienced advisor |

🎯 What to Look for & How to Choose

1. Verify SEBI Registration

Always confirm the channel’s SEBI number on the official SEBI site before trusting trade calls.

2. Observe Free Tier Before Paying

Test the channel’s accuracy over a week or more in demo/paper trading mode before subscribing.

3. Clarity of Calls

The best channels provide clear entry, stop-loss, and target—alongside rationale or chart data—for transparency in trade logic.

4. Learning Orientation

Channels like StockPro and Stock Gainers offer educational content and training—valuable for long-term edge.

5. Risk Disclosure

Trusted channels routinely caution that trading involves risks and suggest only trading with risk capital.

6. Community & Support

Some channels offer chats, Q&A, or user forums—helpful when calls need context or personal query resolution.